Construction activity in Germany and Europe until 2026—current figures on construction activity

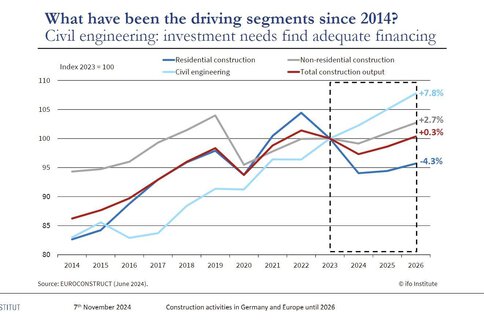

Despite the mixed economic outlook, non-residential building construction is likely to grow moderately (+2.7%), although the pre-corona level remains out of reach.

As part of the BAU Info Talks on 7 and 8 November 2024, Ludwig Dorffmeister, ifo industry expert for construction and real estate, presented the latest figures on the construction industry.

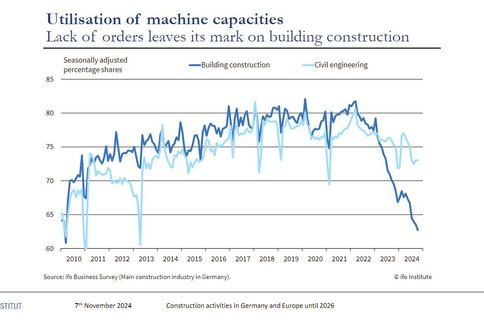

While the coronavirus pandemic only briefly interrupted the prolonged upward trend in the European construction industry, the consequences of the war in Ukraine are preventing further growth in the medium term. In 2026, the construction volume is likely to fall just short of the 2022 figure. The reasons for this include the general economic slowdown, the temporary jump in interest rates, the considerable loss of purchasing power and the sharp rise in construction costs. There are also a variety of country-specific factors that additionally influence the individual markets, such as government construction subsidies.

According to the Summer Forecast 2024, European construction activity will decline by a total of 4% in 2023/24, but will only increase by 3% thereafter until 2026. The civil engineering segment will continue its expansion unperturbed (+7.8%), which is due to the fact that sufficient public and private funds can continue to be mobilised for the extensive investment requirements of the transport and energy infrastructure.

Little prospect of recovery in residential construction

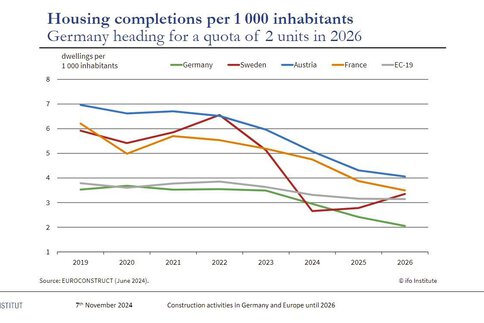

Residential construction, which accounts for almost half of all construction projects in Europe, shrank by a tenth overall in 2023 and 2024 (new construction: -18%). The chances of a significant recovery in the coming years are estimated to be low (-4.3%). The approval forecast is correspondingly cautious. The expiry of an extremely generous subsidy programme for building renovation in Italy is pushing the entire existing building sector into the red. Without Italy, existing building measures in 2026 would be 4.2% higher than in 2023.

Strongest growth in Poland

The minimum growth of 0.3% in the European construction volume between 2024 and 2026 conceals very different developments at country level. In Poland, for example, construction output is expected to increase by 15.2% by 2026 compared to 2023. This is followed by Ireland (+9.5%), the Czech Republic (+8.3%), Sweden (+8.0%) and Norway (+7.6%). Growth of 6.1% is forecast for the heavyweight UK. In fact, the medium-term construction forecasts for most countries are positive. At the same time, however, the markets in the three major countries Italy (-6.7%), Germany (4.1%) and France (-4.0%) are on a downward trend, preventing a more favorable overall picture.

Civil engineering segment continues to expand

Civil engineering has also experienced headwinds in the current decade, which have largely prevented further growth. It is questionable whether the originally forecast increase in civil engineering services of 4% in the period from 2024 to 2026 will remain. On a positive note, the investment efforts of the telecommunications and energy supply companies as well as the further intensified renewal of the supra-regional railroad network—with the help of federal funds—should be highlighted. At the same time, the financing of transport projects—particularly from the public sector—is becoming increasingly challenging. For example, the municipal budget situation has deteriorated considerably in 2023 and the financial deficit is likely to increase again in 2024.

Further figures on the current state of the construction industry can be found on the BAU 2025 website or from the ifo Institute.